HPC hosting revenue in excess of HPC hosting cost of revenue for the fiscal third quarter of 2024 was $1.3 million (13% gross margin). HPC hosting costs consisted primarily of lease expense, power costs, payroll and benefits expense and stock-based compensation expense. Double declining depreciation can you depreciate leased equipment allows you to get a higher deduction the first year you own the equipment. You’ll depreciate your asset or assets at double the rate of the straight-line method. When you buy an expensive piece of new or used equipment for your business, you can take a deduction on your taxes.

Building Better Businesses

You can account for uses that can be considered part of a single use, such as a round trip or uninterrupted business use, by a single record. For example, you can account for the use of a truck to make deliveries at several locations that begin and end at the business premises and can include a stop at the business in between deliveries by a single record of miles driven. You can account for the use of a passenger automobile by a salesperson for a business trip away from home over a period of time by a single record of miles traveled. Minimal personal use (such as a stop for lunch between two business stops) is not an interruption of business use. For more information, including how to make this election, see Election out under Property Acquired in a Like-Kind Exchange or Involuntary Conversion in chapter 4, and sections 1.168(i)-6(i) and 1.168(i)-6(j) of the regulations. A special rule for the inclusion amount applies if the lease term is less than 1 year and you do not use the property predominantly (more than 50%) for qualified business use.

Small Business Lines & Loans

To be depreciable, the property must meet all the following requirements. While ASC 842 presents challenges, it also offers opportunities for improvement. Improved data collection and lease management can lead to better financial planning and decision-making. Accurate financial reporting under ASC 842 can improve transparency and investor confidence. Next, we will explore the challenges and opportunities with ASC 842, including data collection and lease management. Next, we will dive into the specifics of initial recognition under ASC 842 and how to properly record these leases in your books.

Factors that Affect Equipment Depreciation:

- It explains how to use this information to figure your depreciation deduction and how to use a general asset account to depreciate a group of properties.

- If you dispose of all the property, or the last item of property, in a GAA, you can choose to end the GAA.

- Our leasing solutions are structured to meet these standards, ensuring that your financial statements reflect the true nature of your lease obligations.

- However, see chapter 2 for the recordkeeping requirements for section 179 property.

- Qualified property acquired after September 27, 2017, does not include any of the following.

- Improved data collection and lease management can lead to better financial planning and decision-making.

Unadjusted basis is the same basis amount you would use to figure gain on a sale, but you figure it without reducing your original basis by any MACRS depreciation taken in earlier years. However, you do reduce your original basis by other amounts, including the following. You can depreciate real property using the straight line method under either GDS or ADS.

Julie’s business use of the property was 50% in 2022 and 90% in 2023. Julie paid rent of $3,600 for 2022, of which $3,240 is deductible. The $147 is the sum of Amount A and Amount B. Amount A is $147 ($10,000 × 70% (0.70) × 2.1% (0.021)), the product of the FMV, the average business use for 2022 and 2023, and the applicable percentage for year 1 from Table A-19. You are considered regularly engaged in the business of leasing listed property only if you enter into contracts for the leasing of listed property with some frequency over a continuous period of time. This determination is made on the basis of the facts and circumstances in each case and takes into account the nature of your business in its entirety. For example, if you lease only one passenger automobile during a tax year, you are not regularly engaged in the business of leasing automobiles.

Another oversight is not recognizing the impact of tax law changes. The tax code is dynamic, and what was advantageous last year may not be this year. Stay informed about current laws that could affect the tax treatment of your leased equipment.

Figure your depreciation deduction for the year you place the property in service by multiplying the depreciation for a full year by a fraction. The numerator of the fraction is the number of full months in the year that the property is in service plus ½ (or 0.5). On July 2, 2021, you purchased and placed in service residential rental property. You used Table A-6 to figure your MACRS depreciation for this property. In July 2023, the property was vandalized and they had a deductible casualty loss of $3,000.

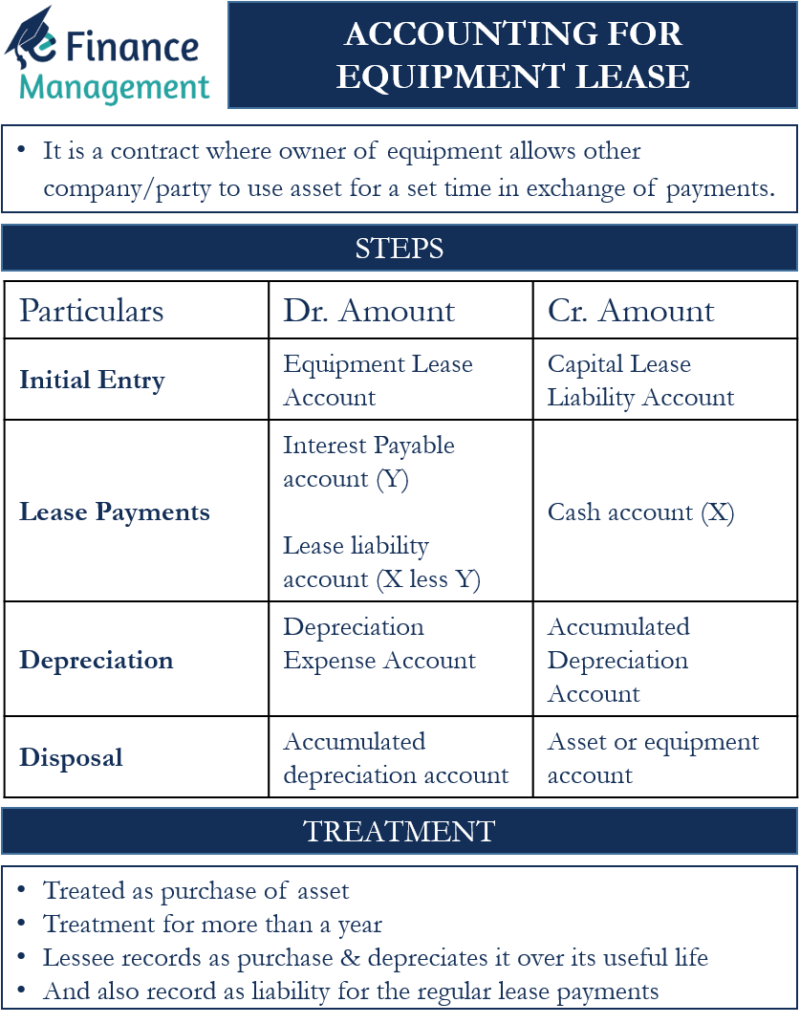

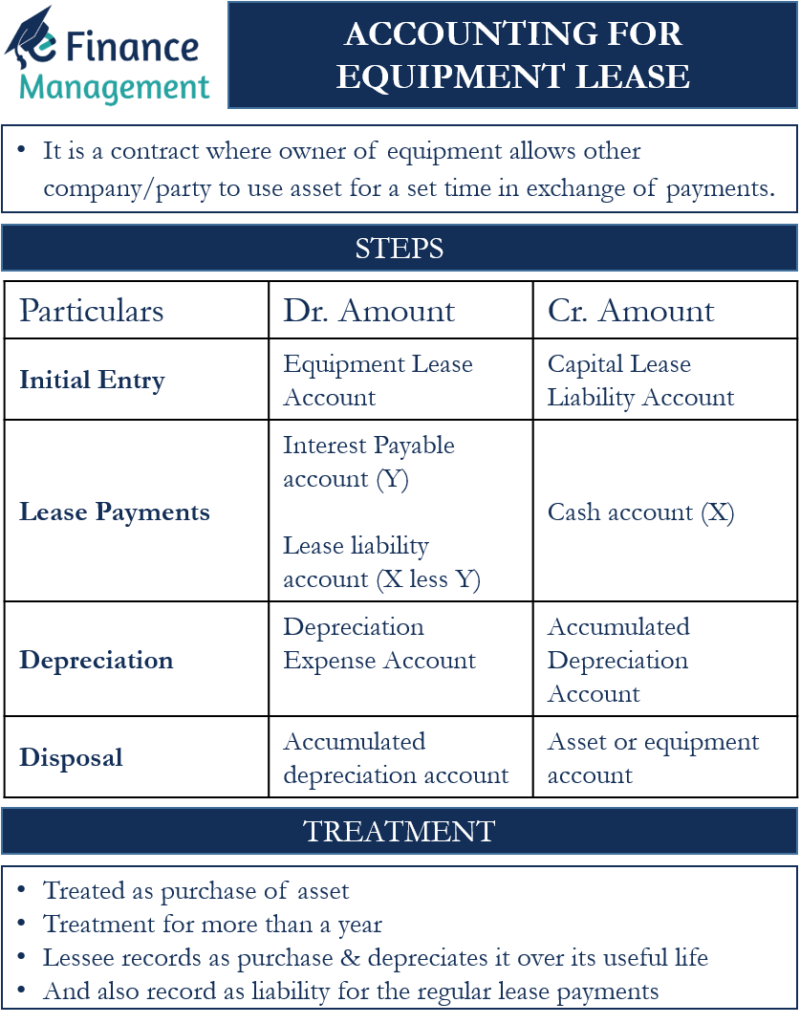

This entry records the interest expense on the remaining lease liability. You can deduct the entire cost of the equipment if you financed it. The depreciation value of the equipment is one thing to consider when considering whether to buy or lease it. There is no hard and fast rate since it depends on the industry you’re in and the equipment in question.